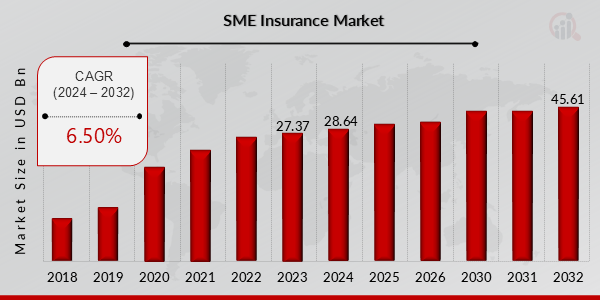

SME Insurance Market Size Reach USD 45.61 Billion by 2032 Growing with 6.50% CAGR

SME Insurance Market Trends

SME Insurance Market Research Report By, Coverage Type, Business Size, Industry, Geographic Reach, Regional

NM, UNITED STATES, March 24, 2025 /EINPresswire.com/ -- The global SME Insurance market has witnessed substantial growth in recent years and is expected to expand significantly in the coming decade. The market size was estimated at USD 27.37 billion in 2023 and is projected to grow from USD 28.64 billion in 2024 to an impressive USD 45.61 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.50% during the forecast period (2024–2032). The growth is primarily driven by increasing awareness of business risks, regulatory compliance requirements, and the rising adoption of digital insurance solutions among small and medium enterprises (SMEs).

Key Drivers Of Market Growth

Increasing Awareness of Business Risks SMEs are recognizing the need for insurance coverage to protect against operational, financial, and legal risks.

Regulatory Compliance Requirements Government regulations mandating business insurance policies for SMEs are driving market expansion.

Rising Adoption of Digital Insurance Solutions The emergence of InsurTech and digital platforms is making insurance more accessible and affordable for SMEs.

Growing Demand for Customized Insurance Policies SMEs require flexible insurance plans tailored to their specific industry and operational risks, fueling market growth.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24599

Key Companies in the SME Insurance Market Include

• AIG

• Tokio Marine Holdings

• Hiscox

• Chubb

• Swiss Re

• Travelers

• Liberty Mutual

• AXA

• QBE Insurance Group

• Allianz

• Munich Re

• Sompo Holdings

• Zurich Insurance Group

• RSA Insurance Group

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/sme-insurance-market-24599

Market Segmentation To provide a comprehensive analysis, the SME Insurance market is segmented based on type, coverage, application, and region.

1. By Type

• Property Insurance: Covers damages to business properties due to fire, theft, and natural disasters.

• Liability Insurance: Protects against legal claims related to injuries, negligence, or malpractice.

• Business Interruption Insurance: Covers financial losses due to unforeseen disruptions.

• Cyber Insurance: Protects SMEs against cyber threats and data breaches.

2. By Coverage

• Standard Coverage: Basic insurance policies offering fundamental protection.

• Customized Coverage: Tailor-made policies catering to specific SME requirements.

3. By Application

• Retail & E-commerce: Rising need for liability and cyber insurance.

• Manufacturing: Extensive coverage for workplace accidents and supply chain risks.

• Healthcare: Demand for professional indemnity and liability insurance.

• IT & Telecom: Growing adoption of cyber insurance solutions.

• Financial Services: High risk exposure requiring comprehensive coverage solutions.

4. By Region

• North America: Dominant market due to strong regulatory frameworks and high insurance penetration.

• Europe: Growth driven by SME-focused policies and increasing risk awareness.

• Asia-Pacific: Fastest-growing region, fueled by a surge in SMEs and digital insurance adoption.

• Rest of the World (RoW): Steady growth expected in Latin America, the Middle East, and Africa due to evolving business environments.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24599

The global SME Insurance market is poised for significant expansion, driven by increased risk awareness, regulatory mandates, and technological advancements in digital insurance solutions. As SMEs continue to prioritize financial protection, the demand for innovative and tailored insurance offerings is expected to surge, fostering growth across various regions and industries.

Related Report:

Brazil Retail Banking Market

Banking and Finance Sector Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release